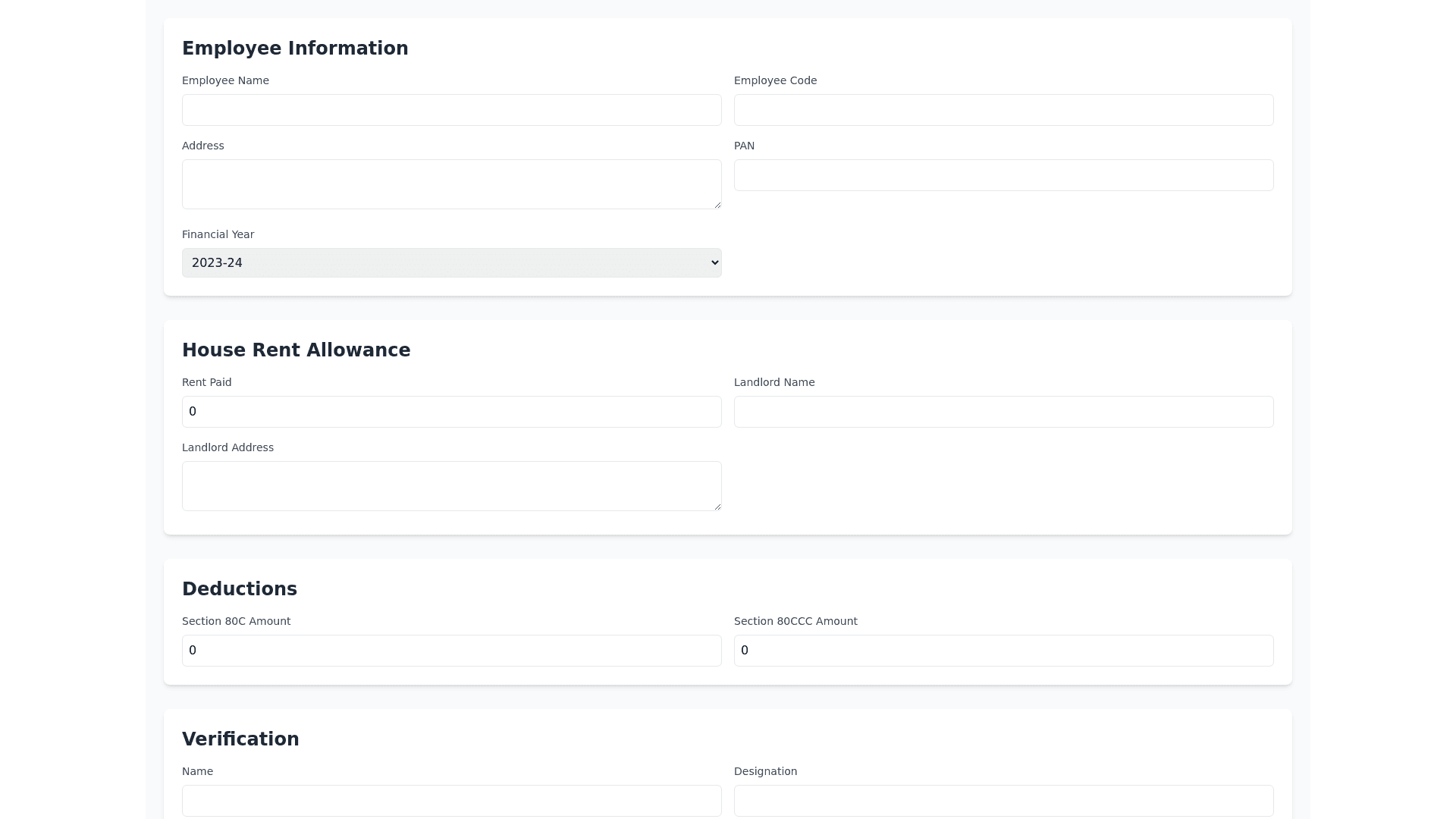

Employee Allowance Form - Copy this Angular, Tailwind Component to your project

First form group 1.Name and Address of the employee 2.Employee Code 3. Permanent Account Number of the employee: 4. Financial year: Old and new as select buttons or dropdown Please note that Option once selected cannot be changed during the year Next it should be rent allownace formgroup with the below form controls House Rent Allowance: (i) Rent paid to the landlord(See Annex I) Amount (Rs.) (ii) Name of the landlord Amount (Rs.) (iii) Address of the landlord Amount (Rs.) (iv) Permanent Account Number of the landlord Amount (Rs.) (if the aggregate rent paid during the previous year exceeds INR 100,000) Amount (Rs.) Next it should be leave travel allownace formgroup with the below form controls Leave travel concessions or assistance Amount (Rs.) Next it should behousig loan allownace formgroup with the below form controls "Interest on Housing Loan (please specify the purpose construction/purchase or renovation) :" (i) Interest payable/paid to the lender (ii) Name of the lender (iii) Address of the lender (iv) Permanent Account Number of the lender (a) Financial Institutions (b) Employer (c) Others Next it should deduction formgroup with the below form controls " (A) Section 80C,80CCC and 80CCD (i) Section 80C (a) ……………….. (b) ……………….. (c) ……………….. (d) ……………….. (e) ……………….. (f) ……………….. (g) ……………….. (ii) Section 80CCC (iii) Section 80CCD (B) Other sections (e.g. 80D, 80E, 80TTA, etc.) under Chapter VI A.) (i) section………………. (ii) section………………. (iii) section………………. (iv) section………………. (v) section………………. " Next it should be others formgroup with the below form controls Verification I,…………………..,son/daughter of……………………….. do hereby certify that the information given above is complete and correct. Place……………………………………………... Date…………………………………………….... Designation ……………………………….…. next should be annexure 1 "Documents to be provided by January 2021: Rent agreement (for monthly rent exceeding Rs10,000) and receipts for all months are to be provided.If the rent amount exceeds rs 100,000 p.a.,the pan of the landlord is mandatory. In the event that the landlord does not have a pan, a letter with name, address and declaration stating that he or she does not have a PAN , should be obtained .In the absence of this, HRA benefit cannot be given " all the months and amount april amout may june july aug sept oct nov dec jan feb mar annexure 2 other income details amount Salary from the previous employer during the year Rental Income Bank interest other income recieved / earned Any other income