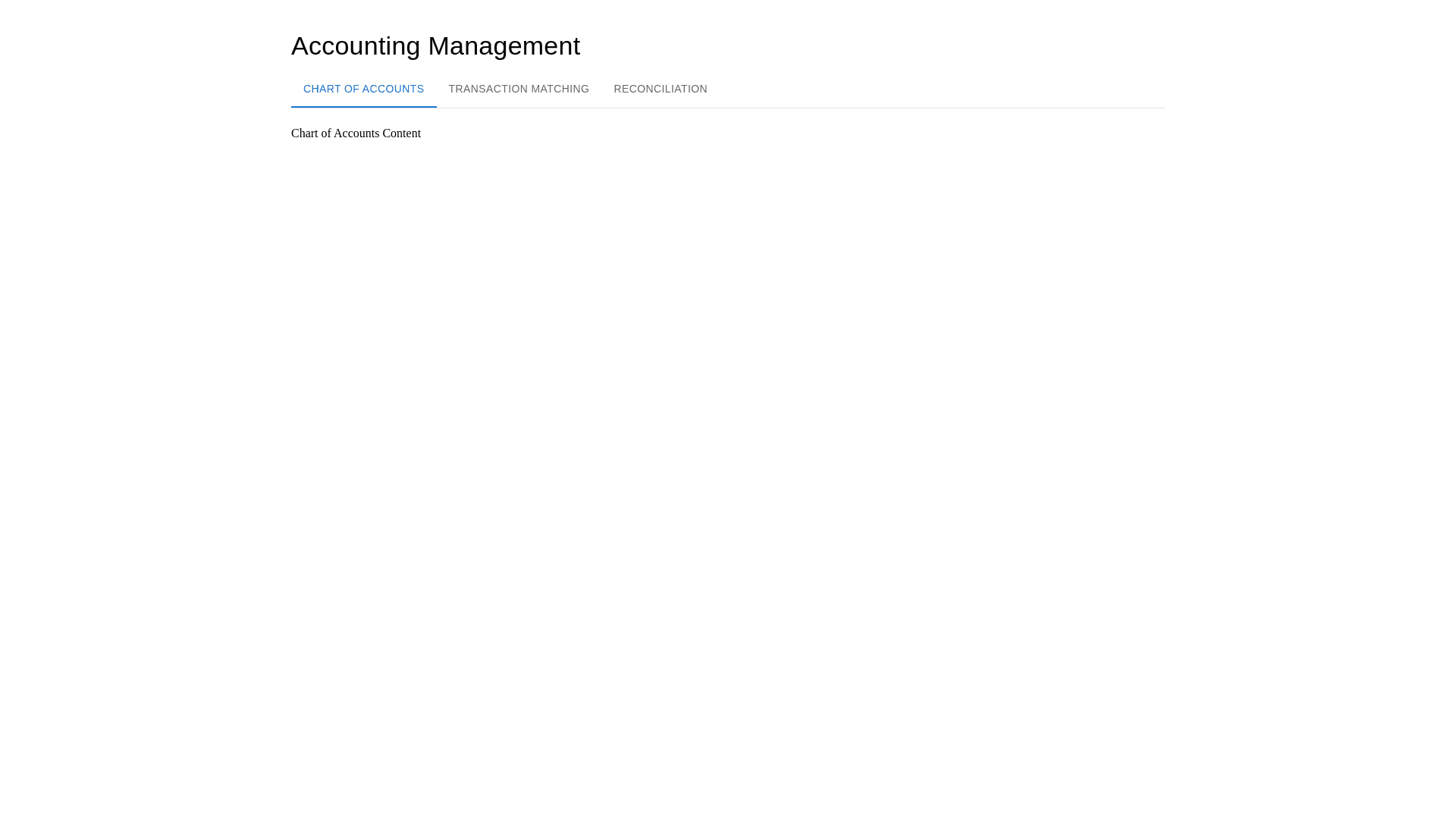

Styled Table Cell - Copy this React, Mui Component to your project

put under Transactions tap: Here’s a rewritten idea for Transaction Matching, based on the chart of accounts details you’ve provided: Transaction Matching for Chart of Accounts Objective: Streamline the process of matching financial transactions to the correct accounts to ensure accurate and timely accounting. 1. Automate Transaction Matching: Implement auto matching functionality to automatically pair incoming bank transactions with existing accounts in the chart of accounts. For example, payments from customers can automatically be matched with Accounts Receivable, while expenses can be linked to corresponding Expense Accounts. 2. Manual Transaction Matching: Allow users to manually match transactions when automatic matching fails or when the system cannot identify the correct account. Provide an intuitive interface where users can: View a list of unmatched transactions. Use filters like date, description, or amount to quickly identify the correct account. Drag and drop or select the correct account to match the transaction. 3. Unknown or Unidentified Transactions: Include a category for Unknown Accounts where transactions are placed when the system cannot automatically match them. Provide a notification or alert for regular review to ensure that unknown transactions are reassigned to the correct accounts. Include options to edit account details if a transaction is incorrectly assigned. 4. Money in Transit: For payments or transfers that are in process but not yet fully processed, use a Money in Transit account to hold these transactions temporarily. Examples include payroll deposits or transactions pending bank confirmation. These should be matched to Wave Payroll Clearing or other similar holding accounts. 5. Expected Payments: Integrate an Expected Payments feature for tracking payments from customers that are expected but not yet received. Automatically match these expected payments to the corresponding Accounts Receivable account once they are confirmed. 6. Integration with Banking Feeds: Set up bank feed integration so that incoming transactions are pulled directly into the system, reducing the manual effort required to track and match payments or withdrawals. Transactions will automatically attempt to match based on details such as account number, amount, and description. 7. Transaction Review Process: Create a Transaction Review Dashboard that allows users to: See a clear list of matched, unmatched, and pending transactions. Quickly navigate through unmatched transactions for easy review and correction. View transaction details with relevant metadata, such as dates, amounts, and descriptions, for a clearer decision making process. 8. Reconciliation & Reports: Enable automated reconciliation of matched transactions between bank statements and the chart of accounts. Generate reports that show: Summary of matched and unmatched transactions. Notifications for pending or failed matches. Reconciliation status with actionable insights to ensure full accounting accuracy. 9. Audit Trail and Notifications: Implement audit trail tracking for transaction matches to monitor changes and ensure data integrity. Send notifications for: Failed or unmatched transactions. Significant discrepancies that require immediate attention. Successful matching confirmations. Key Features for Effective Transaction Matching Smart Matching Algorithms: Automatically match transactions based on descriptions, amounts, and dates. Bulk Matching Option: Allow users to match multiple transactions at once, streamlining the process. Customizable Rules: Allow users to set customizable matching rules, such as certain keywords in the description or exact amounts, for more precise matching. Transaction History: Keep a log of matched and unmatched transactions for review and auditing purposes. Cloud Syncing: Ensure that matched transactions are synced across all devices in real time, making the process accessible from anywhere.